CEO’s Report: Stability in a time of rising energy prices

November 2, 2022There has been a lot of talk in the news lately about rising energy prices.

According to the U.S. Energy Information Administration, natural gas is expected to increase in price by about 22% over last year. Natural gas is the primary heating fuel for 47% of U.S. homes.

According to the agency’s short-term energy outlook, the residential price of electricity in the United States will be up 8% this winter from last year. Higher retail electricity prices largely reflect an increase in wholesale power prices, which are driven by higher natural gas prices.

Heartland Energy is proud to say we’re bucking this trend.

Resources provide hedge against market volatility

Heartland Energy operates within two markets – MISO and SPP. We currently have seven customers in MISO and 23 in SPP.

Our primary generation assets are located in SPP – the coal-fired baseload unit Whelan Energy Center Unit 2 and the Wessington Springs Wind Energy Center. We also have diesel units we contract use of for capacity and emergency use.

We also have a bilateral, financial contract in the MISO market – a 35 MW/hour energy only supply. Similar to SPP, we contract with customers for local generation for capacity and emergency use.

Essentially, when operating within a market, we sell generation into the market, and buy back what is needed to supply our load. Heartland Energy’s goal is to balance sales and purchases within the markets to mitigate risk exposure.

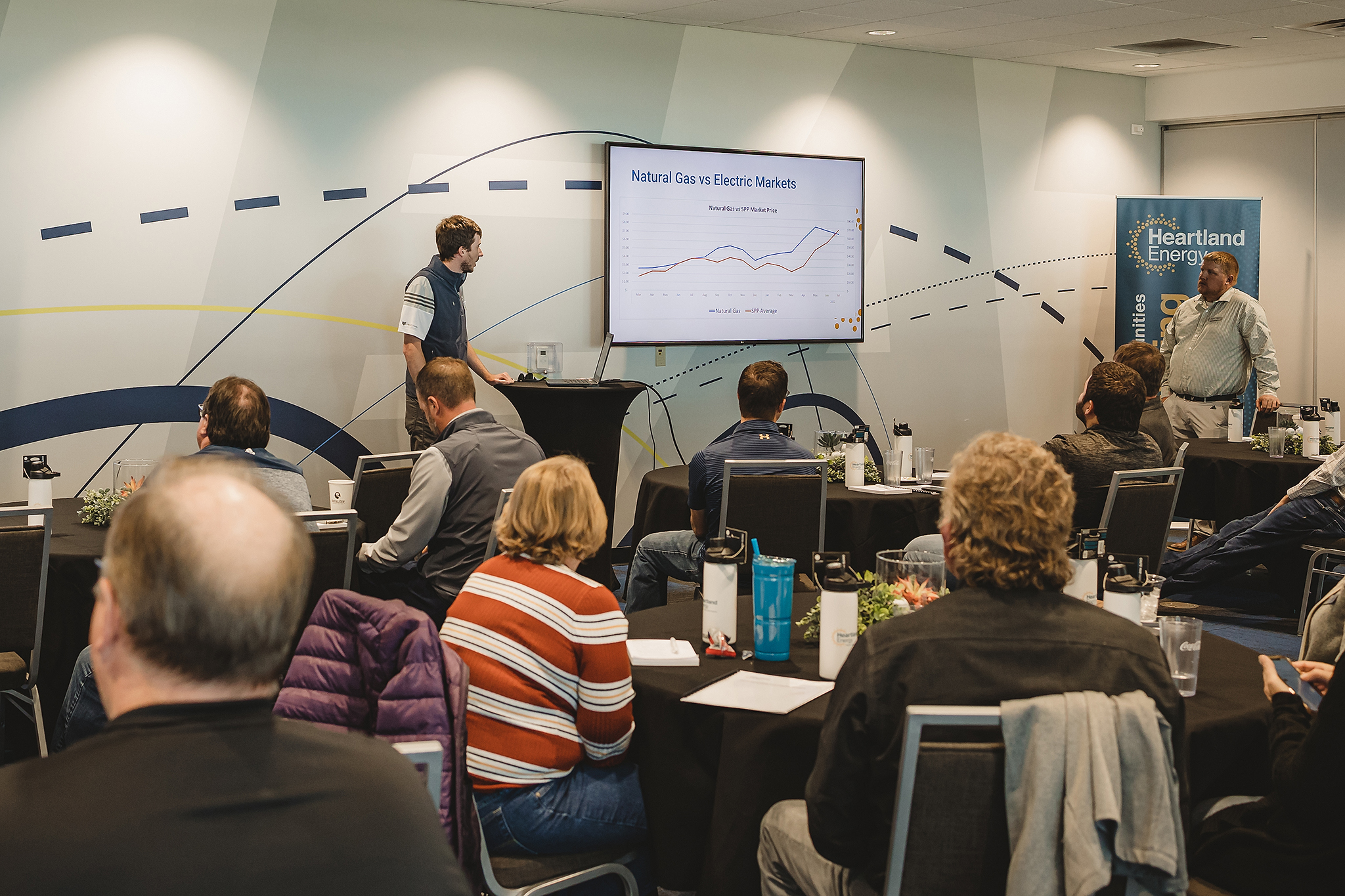

Natural gas’s role in the electricity markets

Natural gas generation is used to fill gaps between traditional baseload generation, namely coal and nuclear, and intermittent resources such as wind and solar. Natural gas is a flexible generation source, starts up fast and can move up and down quickly and often.

As more and more intermittent resources are being built, there is increased reliance on natural gas, which drives electricity prices within the markets up.

The cost of natural gas is a significant driver of electricity prices because it often acts as the marginal fuel in the market. The marginal fuel of generating units determines the price of electricity across the market and lately, natural gas has been the highest cost fuel to drive the market.

During Winter Storm Uri in February of 2021, natural gas acted as the marginal fuel within the market. Extreme cold temperatures restricted the flow of natural gas for power generation and many wind turbines experienced temperature-related outages. Natural gas prices spiked throughout the United States, which led to increased electricity prices.

Rate stability predicted

Because of generation assets in SPP, as well as our bilateral contract in MISO, Heartland Energy is able to mitigate much of the risk of rising market prices.

While we do have to purchase energy from the market to supply load to our customers, we also sell generation produced by our assets into the same market. Our contract in MISO acts as a generator as well to provide stable pricing and offset market purchases no matter what the market price does.

All of this allows for an overall balance.

Bottom line: Because of our market position and a host of other decisions made over the past several years, Heartland Energy is providing rate stability to customers in a time of rising energy prices.