Growth from within strengthens entire district

March 3, 2017Economic development highlights from 2016

To the average citizen, economic development means new businesses and new jobs.

For municipal employees, it also means utility sales, an increased tax base and added infrastructure.

For Heartland customers, it means all of the above plus just a little more.

“Incentives, rebates and loans–all of these programs help build healthy, self-sufficient economies,” said Heartland Director of Economic Development Casey Crabtree. “Healthy economies mean healthy communities, and for Heartland customers, a more stable power district.”

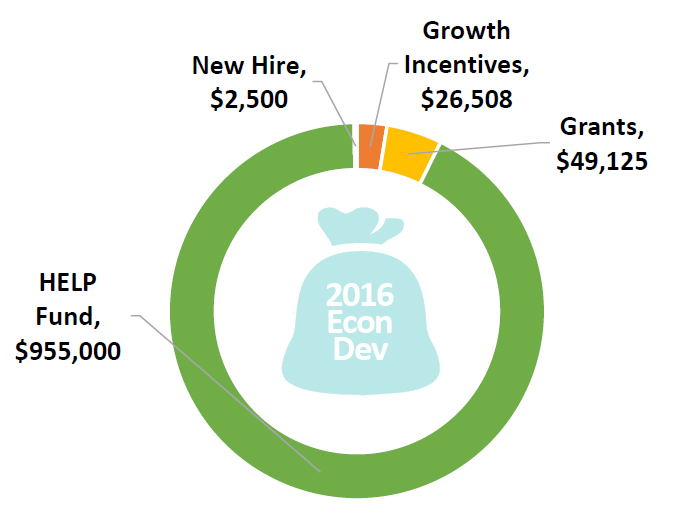

Heartland has been offering development programs for over a decade. Growth and hiring incentives were introduced in 2004, followed by the Heartland Economic development Loan Program (HELP) Fund and economic development grant program in 2005. More recently, the Energy ONE Incentive was established to offer special energy-only rates for new and expanding businesses with significant electric loads.

Although the programs have evolved over the years, the goal has always been to promote and reward growth.

Now under the helm of Crabtree, who joined Heartland in February of 2016, Heartland’s economic development program continues to strengthen our entire customer base by helping individual communities grow.

New face, new approach

When Crabtree started last year, he had a few simple goals: build and strengthen relationships, evaluate Heartland’s current programs and their effectiveness, and secure additional funding for customer use.

Twelve months later, he’s confident he’s achieved these goals.

“I can say with certainty I’ve met or spoken to a developer from every customer community,” he said. “There are a lot of forward-thinking individuals in these cities, many of whom we’ve already partnered with on some type of project.”

Part of getting to know everyone was learning about opportunities and challenges within those communities, and seeing if Heartland’s current lineup was meeting their needs.

“To get a better understanding of what was working and what wasn’t, I needed to see things from their point of view,” he said. “As it turns out, our programs are fairly well-rounded and help fill gaps that might exist in terms of financing.”

According to Crabtree, his best solution was not to change the programs, but to change the way in which they were promoted and implemented.

“This past year and moving forward, Heartland’s role in customer community development is much more assertive and proactive. Rather than waiting for cities to come to us for assistance, we are joining the process on the ground floor, helping pursue opportunities and participating in early discussions.”

New funding, new opportunities

Crabtree also wanted to ensure the programs were available to help all our customers, and took steps to expand HELP Fund services to Minnesota and Iowa.

“The HELP Fund utilizes money from the Intermediary Relending Program from USDA Rural Development. As a result, it’s subject to certain rules that limit the number of counties it can serve,” Crabtree said.

In order to qualify cities in Minnesota and Iowa, Crabtree had to jump through several hoops. This included loaning out all the existing HELP Fund monies and reapplying for new funds with a revised service territory.

His persistence paid off, and he was able to secure $1 million in HELP Funds from USDA with expanded coverage into both Minnesota and Iowa.

As a result, 2016 marked the first time Heartland closed a HELP loan in either state.

In Minnesota, Heartland financing was used to help with Madelia Strong fire recovery efforts. A devastating fire in Madelia in February of 2016 destroyed eight businesses, leaving over 40 people without employment and a giant hole on the city’s Main Street.

“We partnered with a local bank to offer $350,000 to help two businesses,” Crabtree said. “Thankfully, we weren’t the only organization to provide assistance and all of the rebuilding projects are nearly complete.”

In Iowa, Heartland provided a $150,000 HELP loan as gap financing for Chubs Country Store in Akron.

“That project has been nothing short of a huge success. Not only did it create ten jobs and boost the city’s property tax values and utility sales, it also generates a significant amount of sales tax revenue that can then be invested back into the community.”

Crabtree has already begun the process of applying for more IRP funds to replenish the HELP Fund, which only has about 20% funds remaining. He’s not worried about running low on cash, however, due to the nature of program.

“The biggest advantage of the HELP Fund is the fact that it’s revolving. Every dollar we lend will return a profit to Heartland in interest. Every dollar we make, we can put back to work in our customer communities. It’s a win-win for everyone.”

Besides the IRP program, Crabtree has also applied for funding from USDA’s REDLG program, or Rural Economic Development Loan & Grant Program. As a utility provider, Heartland has the unique opportunity to apply for 0% interest loans which are passed through for customer use.

“This is a terrific program for infrastructure projects, start-ups or expansions,” Crabtree said.

Unlike the IRP program, which is awarded annually, REDLG funds can be applied for as-needed. In 2016, Heartland applied for $1.9 million in REDLG funds on behalf of our customers.

New year, new goals

Now that the dust of 2016 has settled, Crabtree is looking forward to what this next year will bring.

“At the moment, we are heavily involved in discussions for two projects that collectively total up to $60 million in capital and could create around 85 jobs,” he said. “We hope to make announcements regarding those projects later this year.”

He is also helping several cities develop industrial parks, including applying for Certified Ready Site status with the South Dakota Governor’s Office of Economic Development. He’s also looking at ways to address housing shortages–a major issue for many Heartland communities.

His ultimate goal is to help position customers so they are ready for any and all growth.

“The fastest, easiest way to strengthen our customer base is to build and grow from within,” Crabtree said. “A growing community means increased electric load. And increased load for one Heartland customer can help ease the burden of power supply costs for all.”